I-Week 2026

⇒Registrations for the courses will be available from 15 September 2025⇐

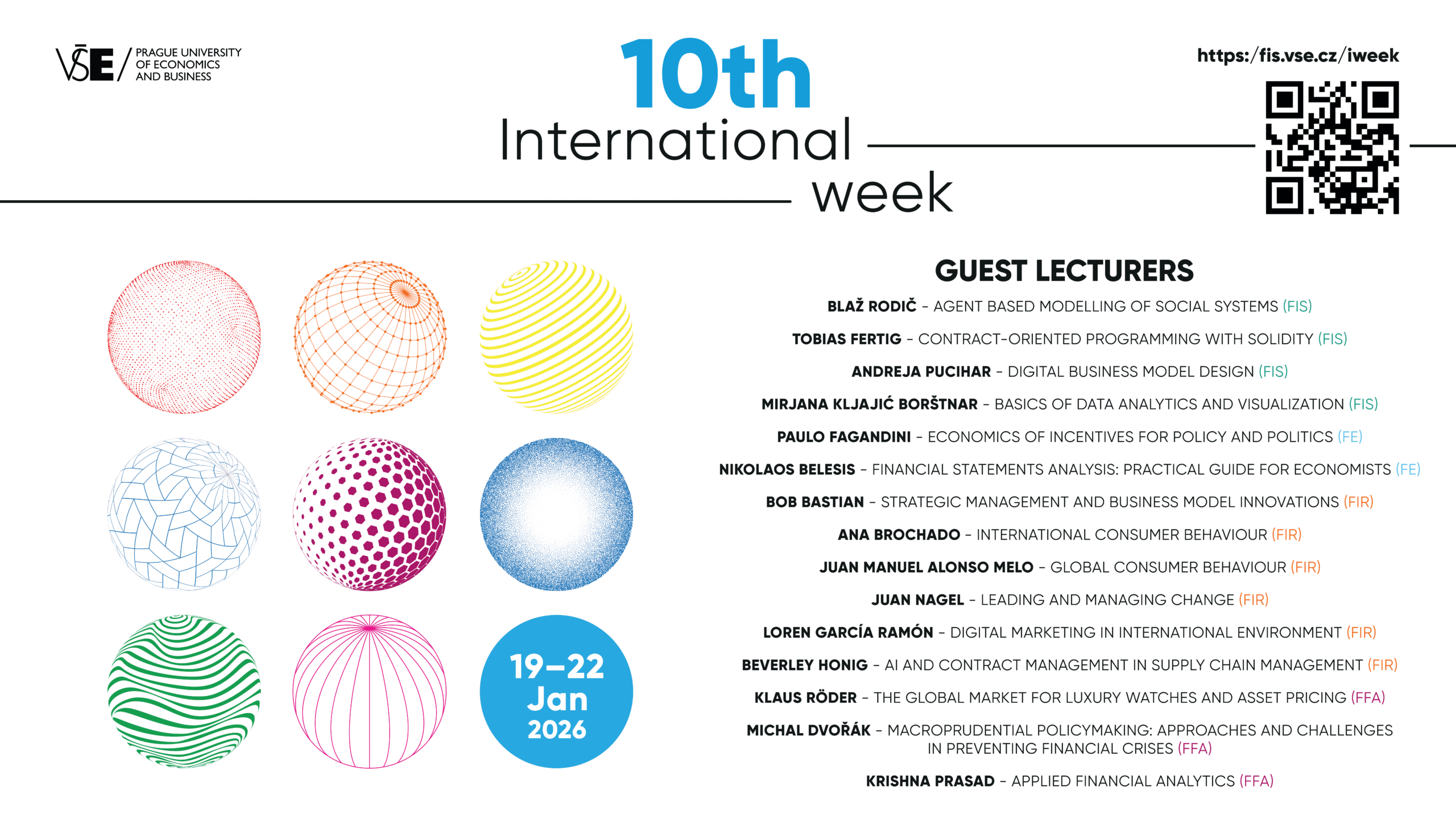

BLAŽ RODIČ – Agent Based Modelling of Social Systems

Course in InSIS – 4SA630, classroom – NB 456, Max. number of students 25

The aim of this course is for students to gain basic knowledge of modelling the living world using the concept of “agents” – models of individual living beings, which may be simple on their own, as individuals, but their interaction in a group can lead to interesting, complex phenomena (e.g. a multitude of ordinary ants or bees creates a complex society). Within the course, the students will learn how we can use models to learn about systems and phenomena, and where we already use or encounter models in our lives, e.g., in computer games. Students will be familiarized with the fundamentals of the simulation modelling research method and the comparison between agent-based modelling (ABM) with alternative and complementary modelling methodologies (system dynamics, discrete event simulation). Main concepts of ABM methodology and the model building process will be presented in more detail, with the focus on the use of agents in modelling of living beings and societies. Finally, students will engage in a hands-on tutorial of using the Anylogic PLE software for interactive agent-based modelling on a case of dissemination of fake news in a social network.

TOBIAS FERTIG – Contract-oriented Programming with Solidity

Course in InSIS – 4IT470, classroom – SB M15, Max. number of students 25

Since the initial launch of Bitcoin, blockchain technologies are continuously growing. In recent years, the blockchain technology has been the basis of many innovations and has attracted a lot of attention. A major milestone in the evolution of the blockchain was the Ethereum project. With Ethereum, an infrastructure was created to operate entire computer programs in a decentralized manner via smart contracts. Smart contracts form the basis for such decentralized applications (DApps). This has been used to enable various Decentralized Finance (DeFi) applications or so-called Nonfungible Tokens (NFTs).

In this course, students will get a short introduction to blockchain but the focus will be on hands-on development of smart contracts with Solidity. Students will learn Contract-oriented Programming in Solidity. At the end of the course, students can develop smart contracts and decentralized applications (DApps) themselves. Moreover, students learn how to secure smart contracts and will learn how to exploit some basic vulnerabilities. As a prerequisite of this course, students should be familiar with programming and software engineering in general.

ANDREA PUCIHAR – Digital Business Model Design

Course in InSIS – 4ST460, classroom – SB 202 (Monday, Tuesday) + NB 469 (Wednesday), Max. number of students 25

The course Digital Business Model Design offers a comprehensive exploration of how digital transformation is reshaping value creation across industries—particularly through the emergence and dominance of digital platforms. From marketplaces and social media networks to service aggregators and data-driven ecosystems, platform-based business models are redefining the rules of competition and innovation. The course examines how such platforms unlock new forms of value by orchestrating interactions between users, partners, and data, and how companies can strategically leverage platform thinking to stay competitive in a digital economy.

MIRJANA KLJAJIĆ BORŠTNAR – Basics of Data Analytics and Visualization

Course in InSIS – 4IZ573, classroom – SB 203 (Monday, Tuesday) + NB 459 (Wednesday), max. number of students 25

This course introduces students to the world of data analytics and visualization, emphasizing its essential role in data analysis and decision support within organizations. Students will learn how to present data in a clear, comprehensible, and visually engaging way to effectively communicate key insights.

The course covers the theoretical foundations of data visualization, including cognitive aspects of perception, the use of color and symbols, and the interpretation of complex data patterns. Students will explore various types of visualizations, techniques for presenting large datasets, data storytelling using graphs, and the application of descriptive statistics to enhance data understanding.

In addition, the course introduces key data mining concepts as a core component of data analytics. Students will learn fundamental techniques such as clustering, classification, association rule mining, and anomaly detection. Emphasis will be placed on how these techniques uncover hidden patterns, relationships, and trends in large datasets, which can then be translated into meaningful visual representations.

PAULO FAGANDINI – Economics of Incentives for Policy and Politics

Course in InSIS – 5EN381, classroom – NB 471, max. number of students 25

His research focuses mostly on applied economics. Previously he worked on corporate finance and applied microeconomic theory, mainly on auctions, contract theory, and matching. He has published research in peer reviewed journals like Computational Economics and Managerial and Decision Economics.

The course has as it main goal to help students understand how incentives shape behavior in organizations of different kinds, and confront them with several situations where the economic theory provides a useful framework to implement solutions to these issues.

By the end of the course, it is expected that students will be able to apply basic game-theoretic and contract-theoretic models to analyze strategic situations, and furthermore, to recognize incentive problems in organizations and public policy settings.

NIKOLAOS BELESIS – Financial Statements Analysis: Practical Guide for Economists

Course in InSIS – 5EN383, classroom – NB 472, Max. number of students 25

He is also assistant Professor in Accounting on the department of Business Administration on the University of Piraeus. He teach in Graduate and Post Graduate level the following courses: Auditing – International Standards of Audit (ISA) Financial Accounting – Managerial Accounting – Accounting for Maritime Companies – Greek GAAP –Accounting Software.

This course offers a practical guide to understanding and interpreting financial statements. It begins with the basics of accounting and the purpose of financial statements, explaining who uses them and why. The course covers all main components such as the balance sheet, income statement, cash flow statement, and equity statement, along with IFRS standards. Students will also learn how to read financial statements and perform analyses using key financial ratios and techniques like horizontal and vertical analysis. A detailed section focuses on auditors’ reports, the role of auditing, and the risks associated with audits. Additionally, the course introduces career paths in auditing and accounting, including certifications like ACA and ACCA. By the end, students will be equipped to analyze financial performance and understand the pathway to becoming a professional in the field.

BOB BASTIAN – Strategic Management and Business Model Innovations

Course in InSIS – 2OP326, classroom – NB 470, Max. number of students 25

The aim of the course is to offer the students an overall view of the latest developments in the field of Strategic Management and Business Model Innovation. It will also help them to solve real-life cases, and by doing so practice problem-solving in groups, arguing for professional opinions and negotiating alternative solutions with team members. The course is partially focused on the modern approaches to strategic management in different fields and partially focused on the application of innovations in companies.

ANA BROCHADO – International Consumer Behaviour

Course in InSIS – 2OP467, classroom – RB 204, max. number of students 25

This theory course examines various theories of consumer behavior and the decision making process from a global perspective. The implications of cultural, ethical and legal variables will also be discussed. In the application part of the course (examples, case studies), emphasis will be put on the American market and the American consumers.

JUAN MANUEL ALONSO MELO – Global Consumer Behaviour

Course in InSIS – 2IB353, classroom – NB 474, max. number of students 25

Juan Manuel Alonso is an Associate Professor at IE University in Madrid, specializing in strategic marketing, branding, and entertainment. He holds dual degrees in Law and Business Administration from Universidad Pontificia Comillas. With extensive experience in managing leading brands across various industries, including Procter & Gamble, Kellogg’s, Kimberly Clark, and Cargill, he has developed a strong expertise in consumer goods, B2B-industrial, and educational sectors. At IE University, he leads the Entertainment Lab, a student-driven initiative that collaborates with companies like Netflix, Sony Music, Meta, and Twitch to develop data-driven projects and strategic recommendations. In recognition of his teaching excellence, he received the Teaching Excellence Award in October 2020. Additionally, he has been appointed as the Career Advisor for the International MBA program at IE University, focusing on a student-centered approach to career development.

The aim of this course is to give a key insight in global consumer behaviour, which is a crucial element of marketing. During lectures main factors influencing behaviour of consumer will be presented, in connections with foundations of psychology, sociology and market research. The course is suitable for students who want to focus on marketing and to know what effects consumers‘ decisions. In the lectures will be used case studies and actual papers from academic journals.

JUAN NAGEL – Leading and managing change

Course in InSIS – 2OP336, classroom – NB 457, max. number of students 25

TThe ability to understand, lead, and sustain change is an important aspect of managing organizations through complex times. In this course, students will understand the leading theories on change management, the interpersonal aspects behind employees’s reactions to change, and the leadership models that have been at the heart of successful turnarounds. Using case studies, we will dissect the process that makes change possible and desirable.

LOREN GARCÍA RAMÓN – Digital Marketing in International Environment

Course in InSIS – 2IB354, classroom – NB 458, max. number of students 25

The aim of the course is to clarify the influence of modern information and communication technologies as an accelerating tool for the development of relationship marketing. Students who successfully complete the course will know the principles of electronic commerce and electronic marketing, including the typology of e-business, e-procurement and especially B2B and B2C marketing in the global environment. Students will understand the penetration of the Internet into communication activities (online advertising, mobile marketing, Internet sales support, social networks such as Facebook, Instagram, LinkedIn).

BEVERLEY HONIG – AI and contract management in supply chain management

Course in InSIS – 2IB354, classroom – RB 203, max. number of students 25

Contract management is a highly powerful discipline in the area of supply chain management. Relational contracts are the new breed of transaction where trust and relationships are the currency of value, and risk is shared between the contracting parties.

KLAUS RÖDER – The Global Market for Luxury Watches and Asset Pricing

Course in InSIS – 1BP555, classroom – RB 435, max. number of students 60

The aim of the course is to prepare students for valuation of stocks and bonds. In particular, the course will also highlight M&A research results and Watch Market analysis. The topics covered in the course include special focus on the German capital market: bond trading, stock trading, exchanges in Germany. The course will be partly based on the textbook of Berk/DeMarzo, Corporate Finance, 6th edition (2024). The part “Luxury Watches” will be based on actual working papers.

MICHAL DVOŘÁK – Macroprudential policymaking: approaches and challenges in preventing financial crises

Course in InSIS – 1BP555, classroom – RB 213, max. number of students 60

This interactive course describes policies initiated after the Global Financial Crises to make the financial market safer. These policies are commonly called “macroprudential policies” in the financial jargon. We will look at the reasons why such policies are needed, what are their objectives, main tools and implications. Most of the course will focus on the banking side of the financial sector which has frequently been at the epicenter of financial crises; however, we also reflect on the increasing role of so-called non-bank players such as investment funds which raises concerns among policymakers. We will also look at potential side-effects of such tools often mentioned in the media, such as the trade-off between financial stability and housing affordability or between financial stability and bank competitiveness. After laying down the foundations of the macroprudential framework and toolkit, we will extensively use case studies to illustrate recent policy actions, including how they are communicated to the public. The lecturer will draw on policy experience from the national and EU authorities and will use their publicly available policy documents as the course material.

KRISHNA PRASAD – Applied Financial Analytics

Course in InSIS – 1VF555, classroom – RB 336, max. number of students 15

The aim of the course is to introduce students to applied financial market analysis using LSEG Workspace. Students will explore various asset classes—equities, fixed income, currencies, commodities, and derivatives—through live data. Emphasis is placed on interpreting macroeconomic indicators, understanding financial instruments, and using analytical dashboards for decision-making.