fis.studies

👉Read the new Blog written by Amrita, ISM student

‼Academic Adventures: Educational Journey to Nice‼

🖊As someone who thrives on new adventures, I jumped at the chance to join the University of Liechtenstein’s Educational Journey program in Nice last month. When our plane landed over the shimmering Mediterranean, I knew this trip would be anything but ordinary. The Côte d’Azur stretched out in a burst of sapphire sea and terracotta rooftops. The place was an epic backdrop. I was looking forward to learning, exploring, and making unforgettable connections on this excursion and that electric inspiration you only get on the French Riviera.

We (students from Prague) landed ✈️early, and since we had time, we began our afternoon in Villefranche-sur-Mer, wandering along its narrow lanes, dipping our feet in the turquoise water, and watching fishing boats and yachts. That evening, we met other students from the University of Liechtenstein and Austria’s Vorarlberg University of Applied Sciences. Initially, it was a bit awkward and boring (story of an international student everywhere) as all of them were German speakers. When they switched to English, they swapped stories about our studies and dreams for the future. It was interesting to learn about their University and education practices.

👉Read the whole blog at our webpage, more information in bio.

#fisbachelor #fismasters #askstudents #blog #ErasmusPlus #exchangeprogram @vseinternationalstudents

2 weeks ago

🌞📅 Summer Opening Hours 📅🌞

As summer approaches, please note our updated opening hours! 🌟

👉EDS Office -

2 July, 9 July, 23 July, 28 July – 9:00-11:00

18 August, 20 August, 25 August, 27 August – 9:00-11:00

👉ISM/EDA Office -

21 July, 23 July, 30 July – 9:00-12:00

18 August, 20 August, 25 August, 27 August – 9:00-12:00

Due to our vacations, office hours are limited to these days only. If you need to visit at another time, please email us first to arrange an appointment.

Make sure to plan your visits accordingly and enjoy your summer with us! ☀️

Stay tuned for more updates and have a fantastic summer! 🌴

#SummerHours #VŠE #StudentLife #Summer2025 #CampusLife #fisbachelor #fismasters #askstudents

2 weeks ago

We are excited to announce a new serie od reels - interviews with teachers at FIS.🎉

First up, we have an insightful interview with Majid Ziaei Nafchi @mad_zid Get to know more about his lecture.

👉And stay tuned for more interviews in the coming weeks!

#teachersatFIS #4quesions4 #studyatvse

3 weeks ago

🌞🔥 FIS Barbecue! 🔥🌞

We had an amazing time at the Faculty of Informatics and Statistics barbecue event last Wednesday! With a record number of 50 students and alumni joining us, it was one of the best events ever. The weather was perfect, the food was delicious, and the atmosphere was unbeatable.

A huge thank you to everyone who came out.

Wishing all our students a wonderful summer ahead! 🌟

#FISBarbecue #StudentLife #SummerVibes #GreatWeather #RecordAttendance #ThankYou #fisbachelor #fismasters #askstudents #fisgraduates @vseinternationalstudents @fis.studies @studyinprague

3 weeks ago

Here’s a sneak peek from the FIS barbecue held last Wednesday! 🌞🔥

Follow us to see more pictures – we’ll be sharing them in two days! 📸

#FISBarbecue #StudentLife #SummerVibes #GreatWeather #RecordAttendance #ThankYou #fisbachelor #fismasters #fisgraduates #askstudents @fis.studies

3 weeks ago

👉Are you a new student and would like to ask our Student Ambassadors about anything related to studies at FIS and moving to Prague?

👉Just ASK THEM!

#askstudents #fisbachelor #fismasters

4 weeks ago

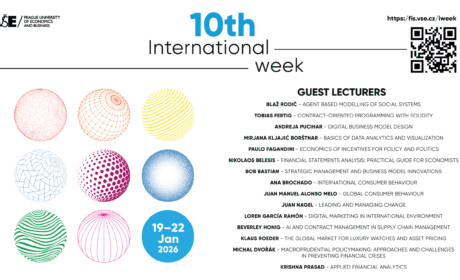

Partners of the Faculty

More information on FIS Partners